M&M Tax Resolution, Client Case Review

A California business owner came to M&M owing the IRS 941 (federal employment) tax and 940 (federal unemployment) tax liabilities totaling approximately $725,000. The tax debts spanned 2009 to 2014. Prior to engaging M&M, this taxpayer wasn't sure who to believe, what to do, when to do it, where to turn or how to handle the IRS Revenue Officer.

It's common for a business owner to get many conflicting opinions about what to do with a $750K tax debt. Prior to talking with M&M, our client got a lot of different "advice" from a lot of different people claiming to be experts. There are more than a few tax resolution companies out there selling some really attractive sounding, but unrealistic options.

- Bankruptcy - We're not bankruptcy attorneys, but we do know that the Trust Fund Recovery Penalty portion of employment taxes will not be discharged in a bankruptcy.

In-Business Offer in Compromise - Not an option for most businesses in this situation. - NewCo - Scares me that companies sell this option before contacting the IRS and before looking at the company's and business owner's financial state.

- Shut Down - Sometimes the right decision, always a tough one.

- Installment Agreement - There are a lot of different IA options available.

- Penalty Abatement - Not as easy as some make it seem, but definitely a real possibility.

Trust Fund Recovery Penalty

This specific client also had the Trust Fund Recovery Penalty (TFRP) to consider. The TFRP, often shortened to just Trust Fund, is the portion of a federal employment tax debt that the IRS can assess and collect from the business owner. This is part of what makes the IRS' collection of payroll tax so aggressive. Our client needed a solid strategy to resolve the tax liabilities for both himself and his business. He made the right choice and hired M&M, the TFRP Experts.

Free Tax Resolution Consultation

M&M's Mark Mitchell was able to outline a solid strategy for our client. While other tax resolution companies focused their plan on promises of big savings and unrealistic settlements, Mark's approach followed the M&M Tax Resolution System (watch the video).

- Current Tax Compliance - M&M conducts an initial investigation into each new client case to determine compliance issues and how to fix them.

- Protection - This taxpayer had already dealt with an IRS garnishment and understood the importance of protection from the IRS.

- Resolution - A formal resolution with the IRS would cement our client's protection from IRS enforced collection actions (levies, seizures, garnishments) for the life of the agreement. It also allows us to request the personal Trust Fund collection be place in CNC status for the life of the business Installment Agreement.

- Request for Reduction - Request for Abatement would be submitted to the IRS once a formal resolution was requested or secured. This gives our client's the best chance for successful penalty relief.

941 Employment Tax Liability Relief and Resolution

As soon as a new client signs up with M&M, one of our Licensed Tax Teams is assigned to the case. This particular client case went to Rebecca Kelly's team. After an initial phone discussion with our new client about the first steps and what to expect, we get to work.

- Compliance - Our Tax Team immediately filed M&M's Power of Attorney with the IRS and determined the severity of the case. Compliance issues were discovered and deadlines negotiated with the IRS Revenue Officer. This is the first step of Protection. Rebecca's Team then communicated the next steps and deadline dates to our new client, including how to gain tax compliance and the specific information we needed with a due date.

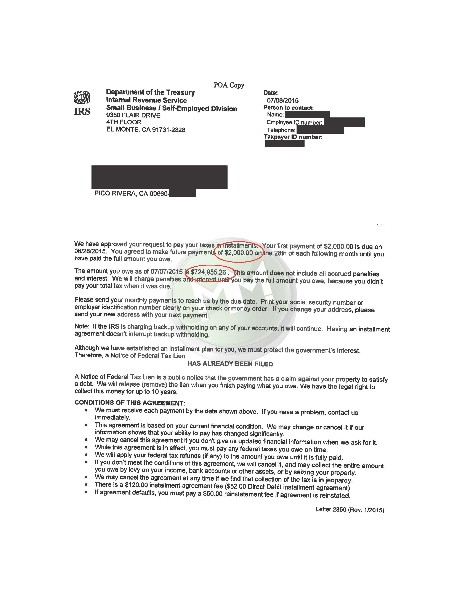

- Protection - Meeting the negotiated deadlines in every IRS case is critical in keeping our clients away from bank levies and other seizures. When a client provides us with the information and documents we need by the specified date, we are able to request protection, in writing, under "Pending" Installment Agreement status. This keeps our clients safe while we negotiate the resolution. While going through this specific client's financial information, Rebecca and her Team discovered that we could request a Partial Payment Installment Agreement (PPIA). Our request for "Pending" status and the PPIA was submitted to the IRS.

- Resolution - Once our formal request for resolution is submitted, we have to wait for the IRS to review it. While we waited on the IRS, we instructed our client how to make Voluntary Payments, how to maintain compliance and how to prepare for the Trust Fund resolution. When it was time to negotiate with this client's RO, we got what we wanted, the PPIA. And although a business PPIA usually means the Trust Fund will be collected from the business owner personally, this particular client was fortunate. We were able to have the TFRP collection placed on hold in CNC status while the business makes the monthly PPIA payments.

- Reduction - Many of M&M's clients proceed to request the Abatement of Penalties. For this particular client, penalties were not an immediate concern because the PPIA was set up to reduce most of the tax debt.

$2,000 x 109 months = $218,000. This agreement could save our client more than $500,000, before adding in the IRS' running interest on the debt.

The PPIA isn't a fit for every M&M client, but it works for a lot of them. If you're unsure of what to do next, let us outline an option for you. We've been helping business owners with payroll tax liabilities since 2005. We have a 15 day money back guarantee. Tell us about your situation. You'll be glad you did.